Payment Services - Naranjax

At Naranjax, with over 3,000 employees, managing numerous stakeholders and external parties was crucial due to the project's complexity. Creating a workboard in Miro became essential, as our starting point to clearly define project objectives, constraints, and business requirements. It also helped us align on the technology stack, ensuring everyone involved understood the project's scope and direction.

Navigating Bill Payments in Argentina

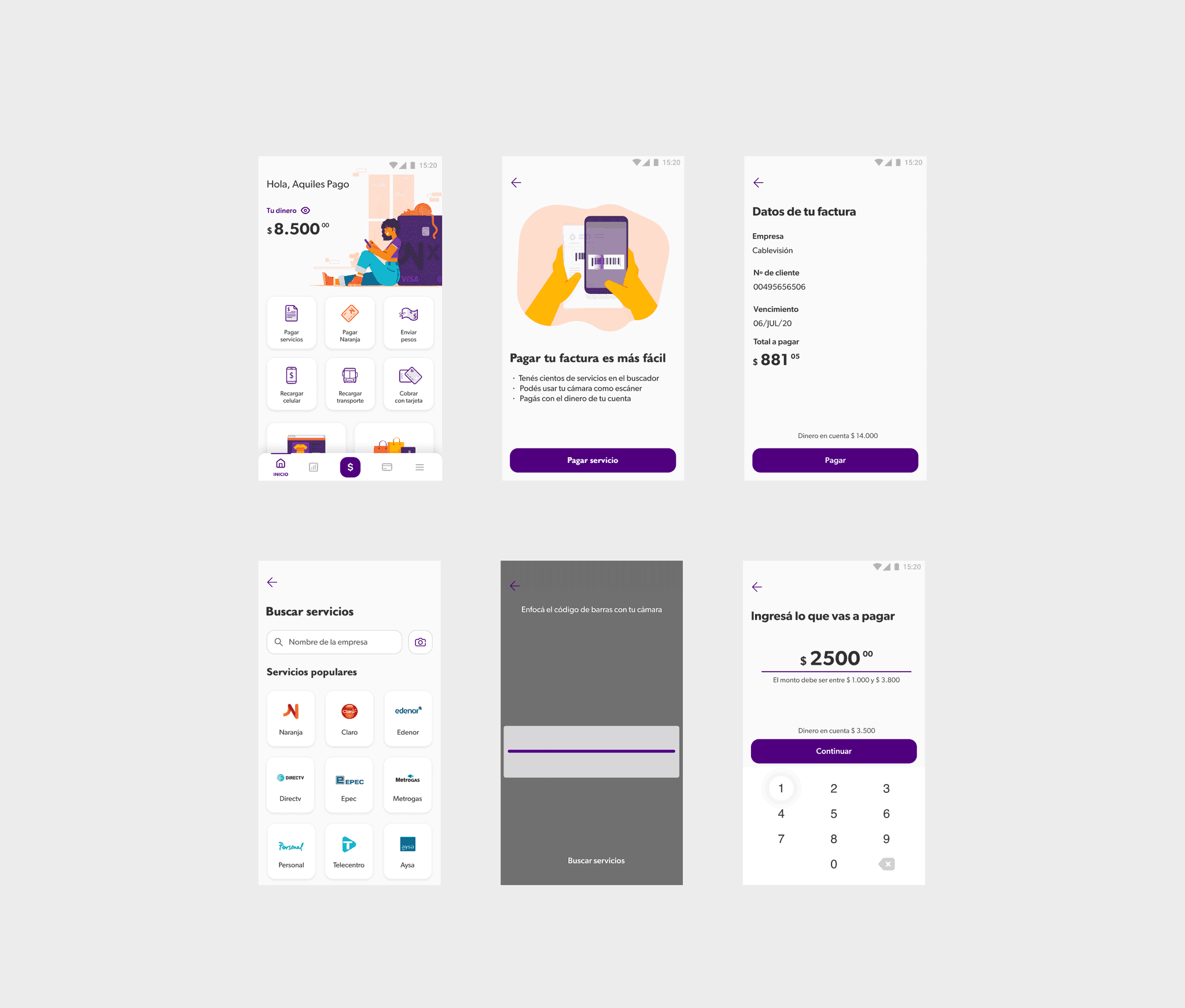

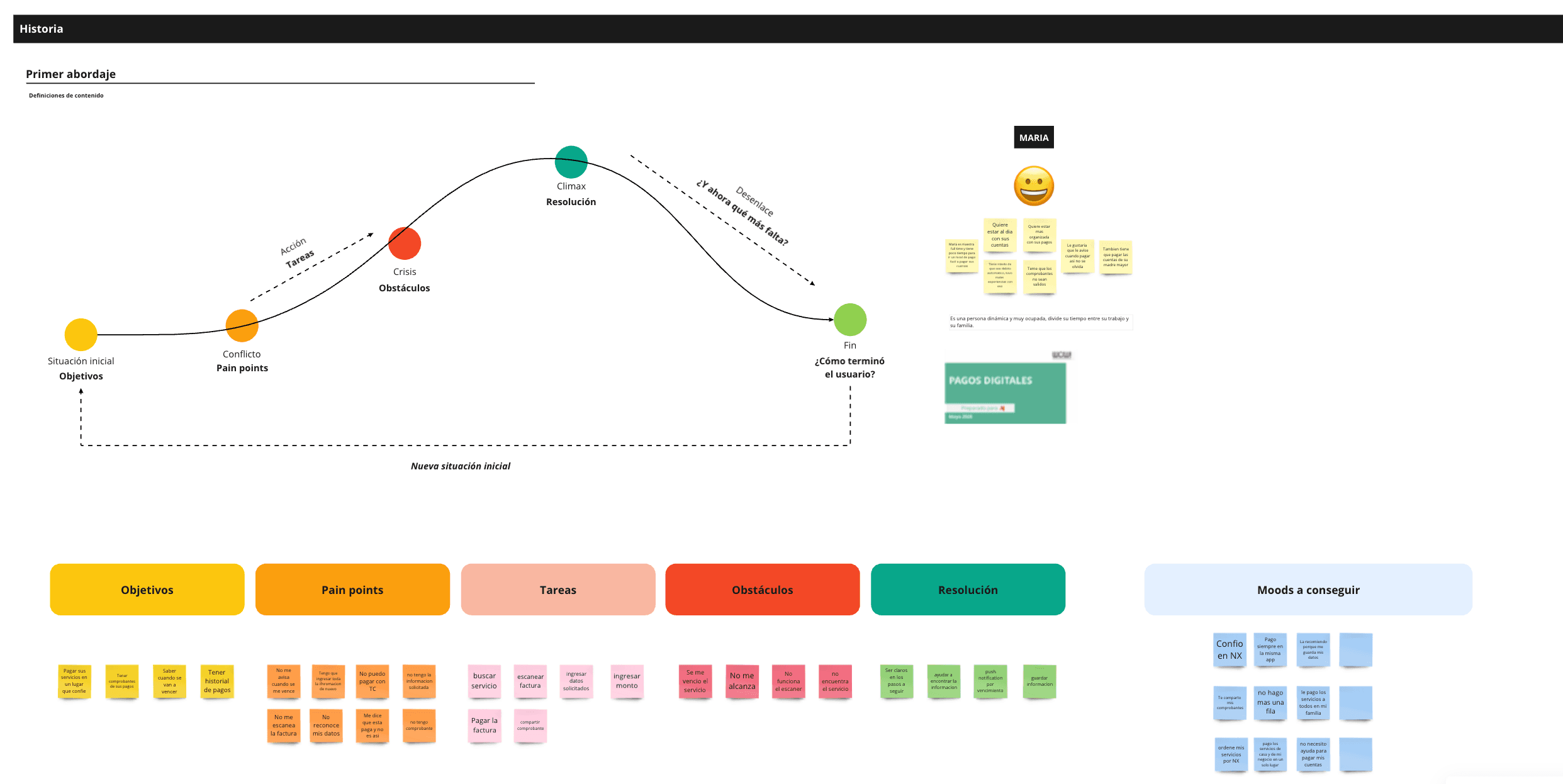

The process began with comprehensive desk research and benchmarking, which guided the development of features and user flow design. It was found that most Argentinians preferred to pay their utility bills (electricity, water, gas, taxes) at specialized physical locations. These places offered the convenience of handling all payments in one spot with various payment options. However, with the onset of the pandemic, these locations had to close and lacked the technology needed to support a surge in online payments.

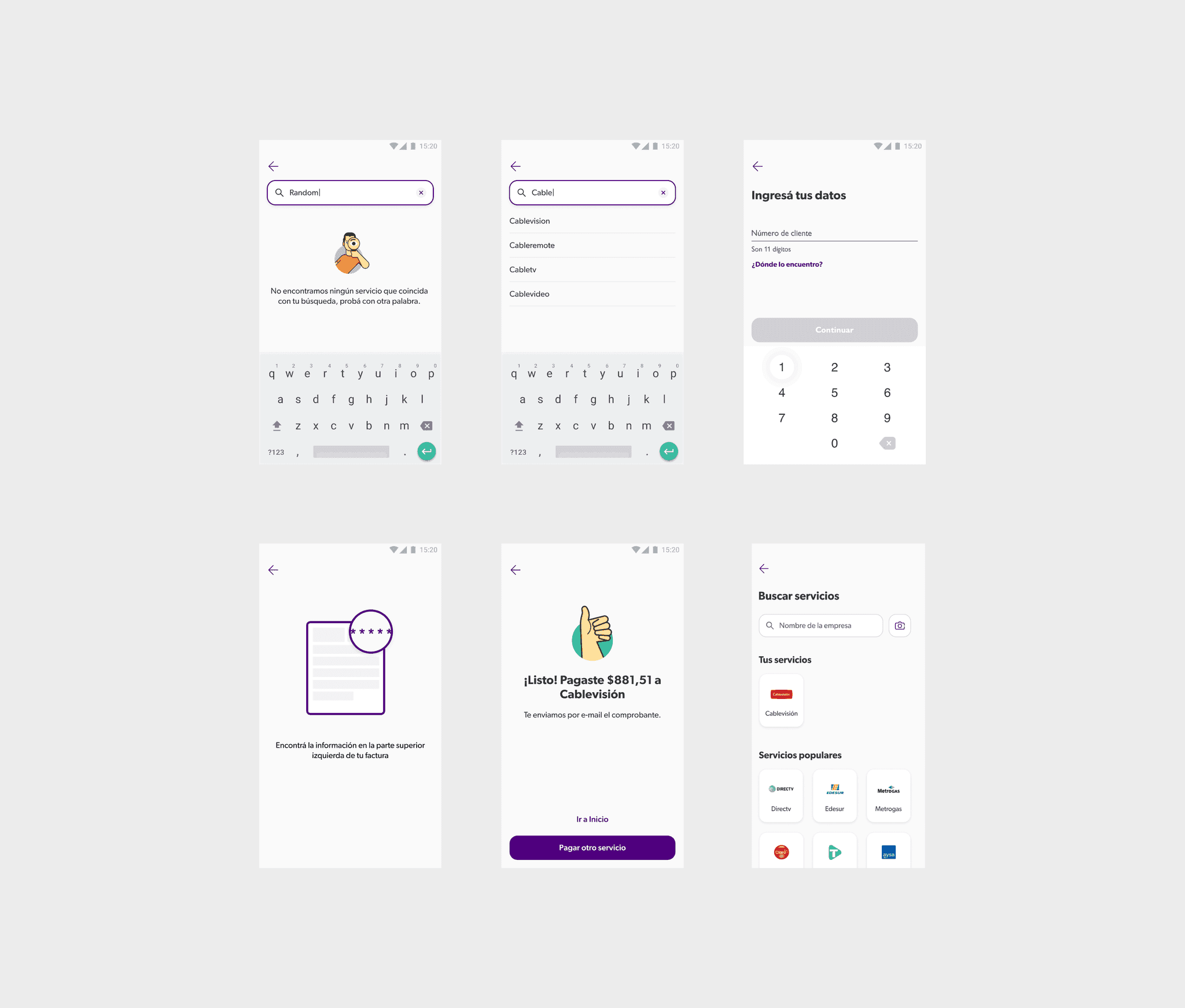

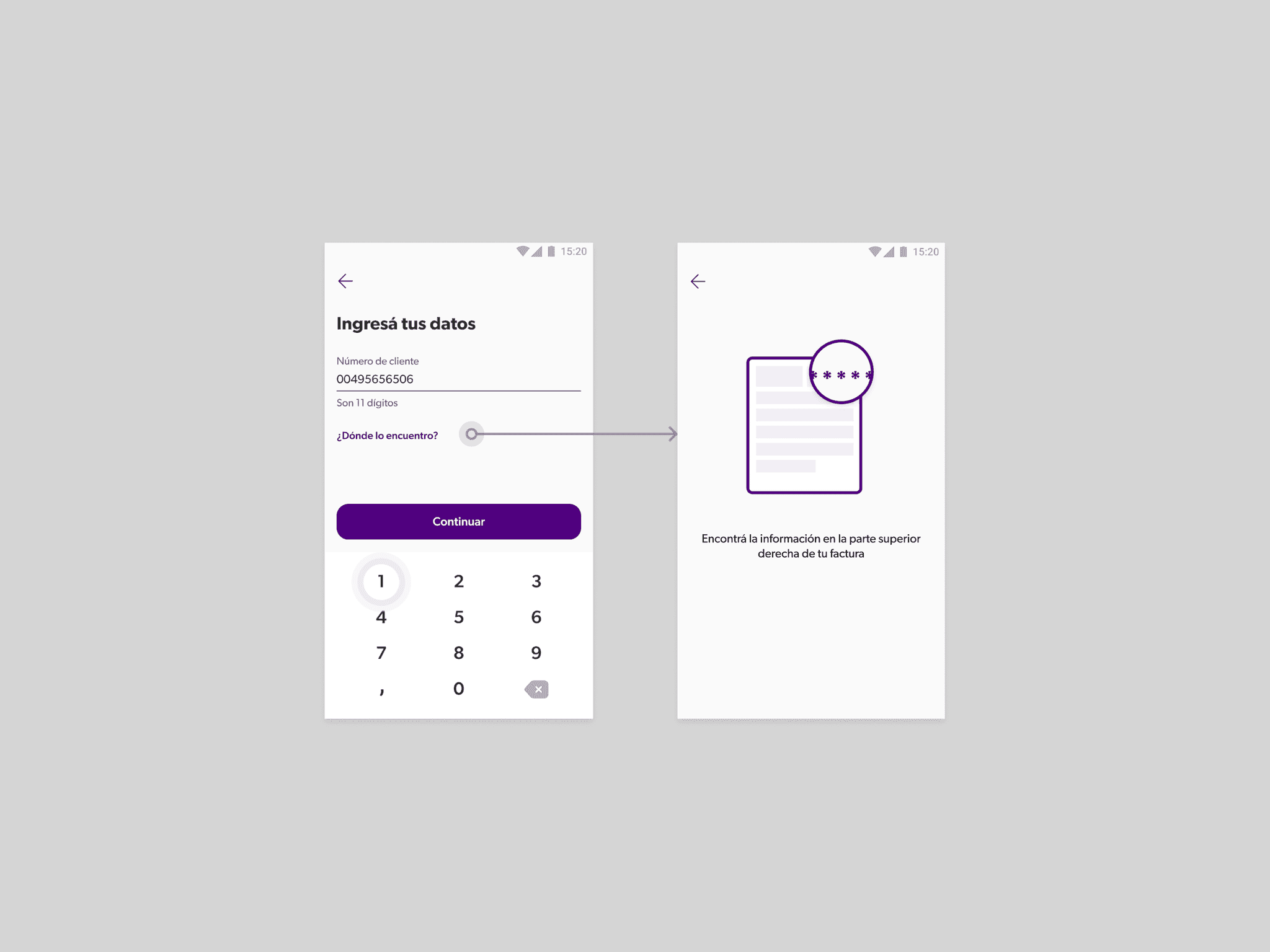

Additionally, users faced frustration with online bill payment due to the need to enter a client number or other identifiers for each bill, often in different formats. This was a new experience for many, who were accustomed to having an employee handle these tasks at physical locations. Consequently, users frequently waste time searching for the correct data or entering incorrect codes.

Defining Goals

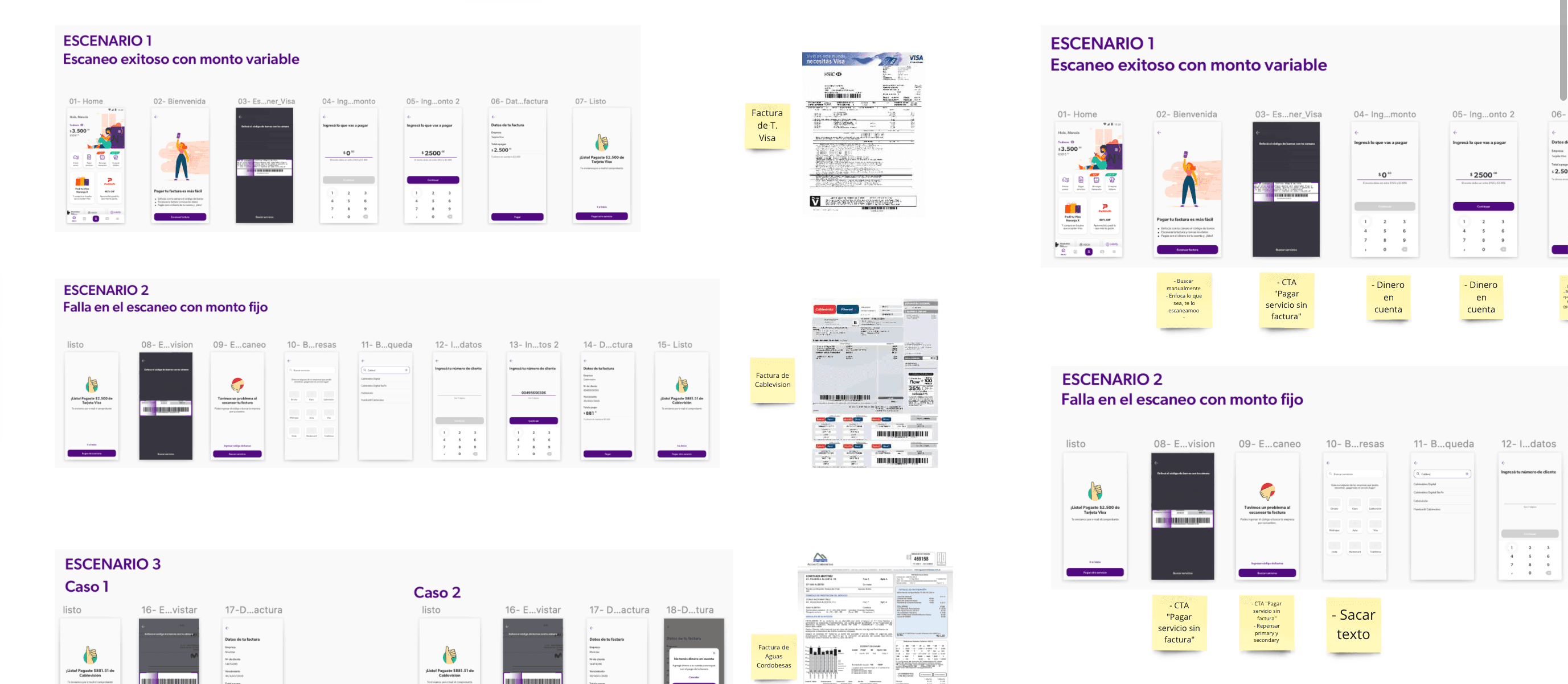

With a clearer objective in mind, the goal now is to create a feature that allows invoices to be read automatically by a mobile phone using a scan, simplifying the bill payment process and providing access to various payment options available in the Argentine market.

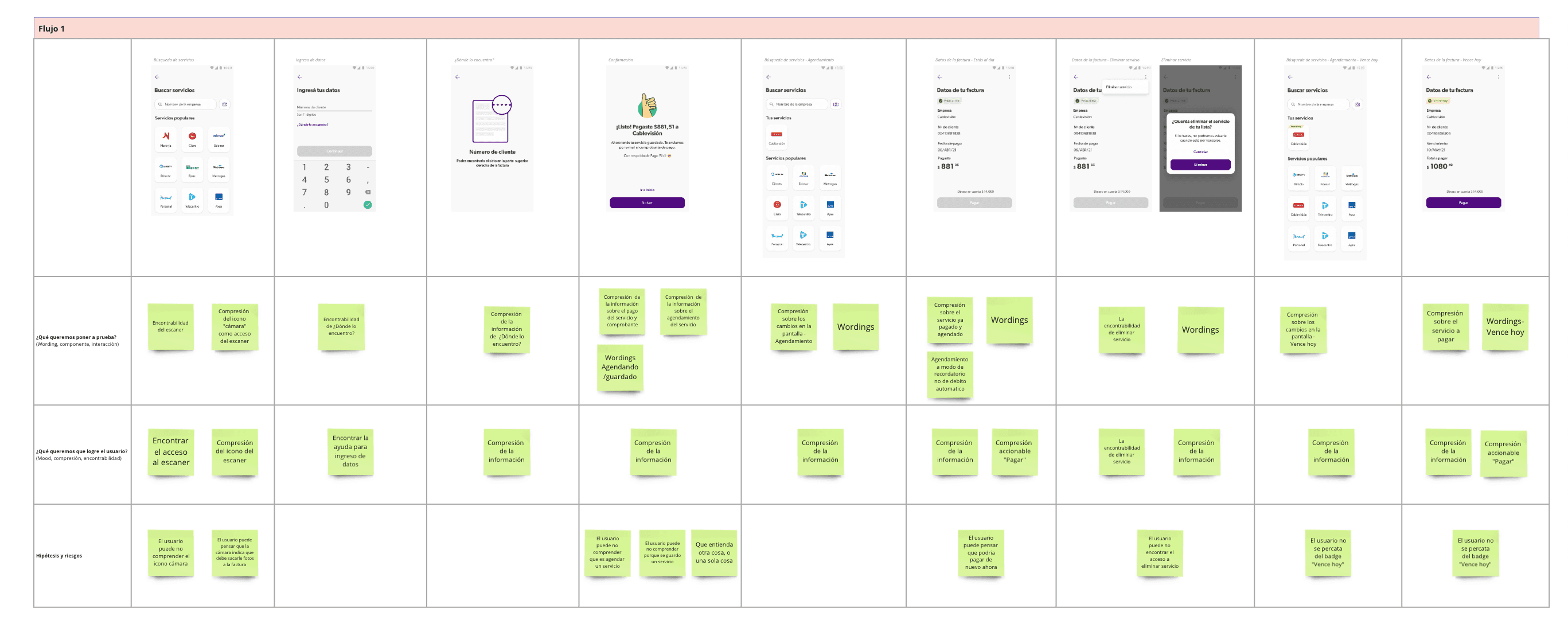

To achieve this, it was necessary to break down the requirements into finer details. A key role was played in creating user stories, focusing on essential aspects and using business needs as a guide. Below are four key sections of the application, each with its sub-requirements and objectives.

✦ Onboarding for New Features

✦ Scan Services

✦ Manual Service Search

✦ Fixed vs. Variable Amount Invoices

✦ Account Balance Component

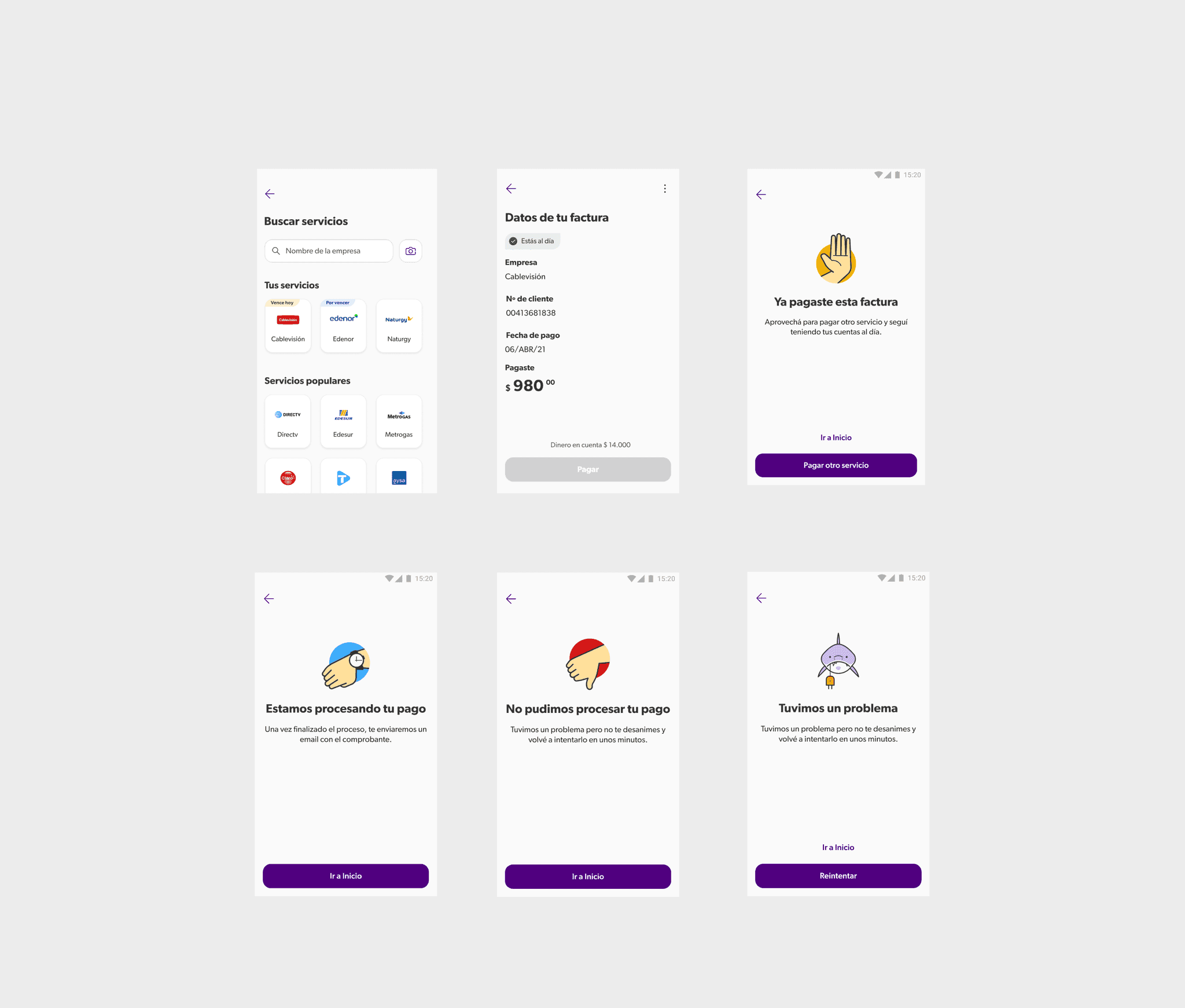

✦ Handling Non-Ideal Scenarios

✦ Payment Service Options

Insights from Bill Payment Testing

I had the opportunity to test the workflows with NX users. I developed prototypes to explore various scenarios, including successful transactions, two types of failed invoice scans, bill scheduling, and notifications. After preparing user test scripts, conversion sheets, selecting tools, arranging post-test rewards, and organizing interviews, we tested with 15 users. The goal was to gauge their reactions to our workflows, assess whether we effectively addressed their bill payment issues, and collect feedback on their experiences with competitors.

The feedback was enlightening, revealing challenges with timely payments and receipt organization. One user pointed out, "It's hard to keep track because everything has a different expiration date." This highlighted the need for centralized receipt management, email copies, and timely payment reminders.

After gathering results from the usability tests, I iterated on the screens for the different user cases. Once the handoff was completed with all the necessary documentation, we launched a friends and family test to trial all the services now ready in the app. It was a success—we had never seen so many people happily paying their bills. Users felt a sense of relief, as if a weight had been lifted off their shoulders.

In the first week after going live, we processed 2.61k paid services, with an average ticket of $4,000, totaling $15 million in TPV. This feature quickly became one of the most used in the NX app, generating millions of transactions annually.